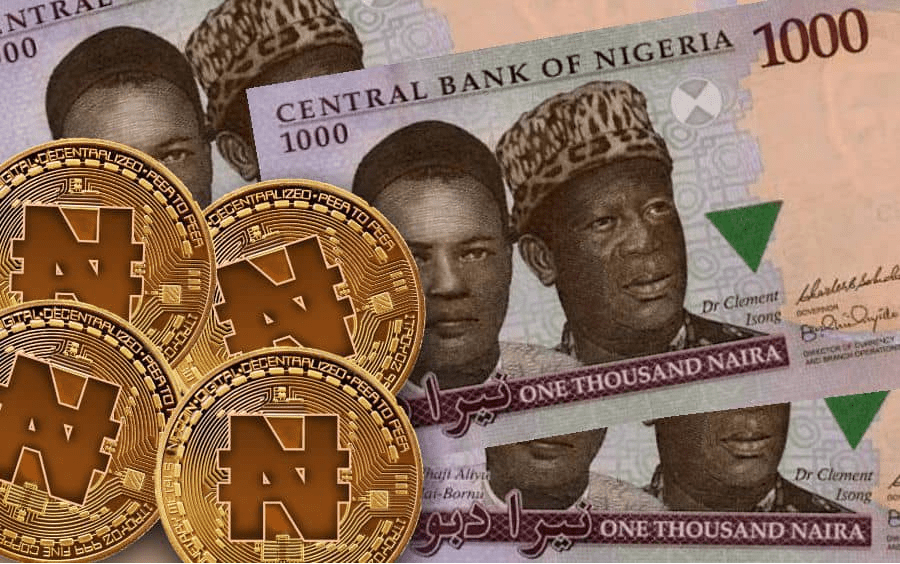

Cryptocurrency has become a buzzword in Nigeria in recent years. The adoption of digital currencies has grown exponentially, especially among the youth. In this article, we'll explore the state of crypto in Nigeria, its benefits, and the challenges it faces.

The Rise Of Crypto In Nigeria

Nigeria is among the top countries in the world with the highest adoption of cryptocurrencies. This can be attributed to a variety of factors such as:

- Financial exclusion:Nigeria has a large population of unbanked people who lack access to traditional banking services. Cryptoprovides a cheaper and faster alternative for remittances and transactions.

- Youthful population:Nigeria has one of the youngest populations globally, with over 50% of the population under 30 years old. The youth are more tech-savvy and open to new digital innovations, including cryptocurrencies.

- Economic instability:The Nigerian economy is highly volatile, and the value of the Naira has been decreasing steadily over the years. Many Nigerians see cryptocurrency as a way to hedge against inflation and store value.

Benefits Of Crypto In Nigeria

The adoption of cryptocurrencies has several benefits in Nigeria, including:

- Cheaper transactions:Crypto transactions are cheaper than traditional banking transactions, making it an ideal option for small businesses and low-income earners.

- Financial inclusion:Crypto provides financial services to the unbanked and underbanked population in Nigeria, improving financial inclusion.

- Increased remittance inflow:Nigerians living abroad can use cryptocurrencies to send money back home, bypassing the high fees charged by traditional remittance services.

Challenges Of Crypto In Nigeria

While crypto adoption is on the rise in Nigeria, it still faces several challenges, including:

- Regulatory uncertainty:The Central Bank of Nigeria has not yet regulated cryptocurrencies, leaving investors and traders unsure of the legal framework around cryptocurrencies.

- Cybersecurity risks:Crypto transactions are vulnerable to cyber attacks, and Nigeria has a high rate of cybercrime. Investors and traders must take extra caution to avoid falling victim to scams and hacks.

- Volatility:The cryptocurrency market is highly volatile, and the value of cryptocurrencies can fluctuate wildly in a short time. This makes it a risky investment option for many Nigerians.

The Future Of Crypto In Nigeria

The future of crypto in Nigerialooks bright, with more startups and exchanges emerging, and the adoption of cryptocurrencies continuing to grow. The Nigerian government is also taking steps towards regulating the crypto industry, which will provide clarity and stability for investors and traders.

One of the most significant developments in Nigeria's crypto industry is the proposed launch of the eNaira, Nigeria's central bank digital currency (CBDC). The eNaira is expected to provide a more efficient and secure payment system and promote financial inclusion in the country.

However, the launch of the eNaira also raises questions about the role of private cryptocurrencies in the Nigerian economy. Some experts argue that the eNaira could compete with private cryptocurrencies, while others believe that both can coexist and complement each other.

The Role Of Education In Nigeria's Crypto Industry

As the adoption of cryptocurrencies continues to grow in Nigeria, there is a need for more education and awareness about the risks and benefits of digital assets. Education is critical to reducing the chances of Nigerians falling victim to scams and hacks, as well as encouraging more informed investment and trading decisions.

Several initiatives have been launched to promote education and awareness about cryptocurrencies in Nigeria. For example, the Blockchain Nigeria User Group (BNUG) offers training and mentorship programs on blockchain technology and cryptocurrencies. Additionally, several crypto exchanges in Nigeria offer educational resources and tutorials on trading and investment in digital assets.

Importance Of Regulation In Nigeria's Crypto Industry

Regulation is essential for the sustainable growth of the crypto industry in Nigeria. It provides a legal framework for investors and traders, reduces the chances of fraud and scams, and promotes confidence in the industry.

In recent years, there have been calls for the Nigerian government to regulate the crypto industry. The Central Bank of Nigeria has taken steps towards this by creating a framework for licensing and regulating Payment Service Providers (PSPs) who provide services to crypto exchanges and other digital asset companies.

Additionally, in 2021, the Nigerian Securities and Exchange Commission (SEC) recognized cryptocurrencies as a form of security, which provides more clarity and stability for investors and traders.

The Future Of Crypto Adoption In Nigeria

The future of crypto adoption in Nigeria looks promising, with more startups and exchanges emerging, and the government taking steps towards regulating the industry. The launch of the eNaira, Nigeria's central bank digital currency, could also provide a more efficient and secure payment system and promote financial inclusion in the country.

However, the crypto industry in Nigeria still faces challenges such as cybersecurity risks, volatility, and regulatory uncertainty. The government and industry stakeholders must work together to create a regulatory framework that balances innovation and security while promoting financial inclusion.

The Impact Of Crypto On Remittances In Nigeria

One of the most significant benefits of crypto adoption in Nigeria is the potential impact on remittances. Remittances are a crucial source of income for many Nigerians, with the country receiving an estimated $17.2 billion in remittances in 2020.

Traditional remittance channels are often expensive and slow, with high fees and long processing times. Crypto offers a faster, cheaper, and more accessible alternative for Nigerians to receive and send money from abroad.

Several crypto exchanges in Nigeria offer services that allow Nigerians to receive and send money using cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. These services are often faster and cheaper than traditional remittance channels, with lower fees and quicker processing times.

Moreover, the launch of the eNaira, Nigeria's central bank digital currency, could provide a more efficient and secure payment system for remittances. The eNaira could reduce the reliance on traditional remittance channels and provide a more accessible and affordable way for Nigerians to receive and send money from abroad.

The Role Of Crypto In Financial Inclusion In Nigeria

Crypto adoption in Nigeria could also play a significant role in promoting financial inclusion. According to the World Bank, Nigeria has a financial inclusion gap of 36%, with only 36.9% of the adult population having access to formal financial services.

Crypto offers a more accessible and affordable way for Nigerians to access financial services, especially for those who are underserved by traditional financial institutions. For example, crypto exchanges in Nigeria offer services such as savings accounts and lending, which are often unavailable or expensive through traditional banks.

Moreover, the launch of the eNaira could promote financial inclusion by providing a more efficient and secure payment system for Nigerians who do not have access to traditional financial services. As Nigerian you can learn more on crypto visiting Washington Independent website an learn all aboutcryptocurrency and digital money.

People Also Ask

Is Crypto Allowed In Nigeria?

Cryptocurrencies are allowed in Nigeria. However, the regulatory landscape for the crypto industry in Nigeria is still evolving, with the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission(SEC) taking steps towards regulating the industry.

Which Crypto Is Best In Nigeria?

There are several cryptocurrencies available in Nigeria, and the choice of the best cryptocurrency depends on an individual's investment goals, risk tolerance, and personal preferences. However, Bitcoin is the most popular cryptocurrency in Nigeria, followed by Ethereum and Binance Coin.

What Is Nigeria Crypto Called?

Nigeria's central bank digital currency (CBDC) is called the eNaira, which is expected to launch in 2021. The eNaira will be a digital version of the country's fiat currency, the Naira, and will be backed by the central bank. The launch of the eNaira is expected to provide a more efficient and secure payment system for Nigerians and promote financial inclusion.

Conclusion

In conclusion, the adoption of cryptocurrencies in Nigeria is a growing trend with several benefits, including financial inclusion, cheaper transactions, and increased remittance inflow. However, it also faces challenges such as regulatory uncertainty, cybersecurity risks, and volatility.

Despite the challenges, the future of crypto in Nigeria looks promising, with more startups and exchanges emerging, and the government taking steps towards regulating the industry. The launch of the eNairacould also provide a more efficient and secure payment system and promote financial inclusion in the country. As crypto adoption continues to grow in Nigeria, it could revolutionize the financial sector and provide a more accessible and affordable financial system for all.